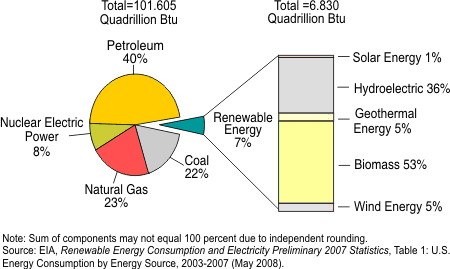

Not all the alternative generation of energy is really taken into account because numerous small-scale projects are inevitably overlooked. The Energy Information Administration (EIA) does make available figures on the economy, crude oil prices, and alternative resources to the best of their data collecting ability. This information is almost constantly revised as more data is available but the changes and revisions are not especially dramatic. The change in energy consumption and sources of energy is an evolutionary process and not a revolutionary process.

Anna W. Crull | STIX, Inc.

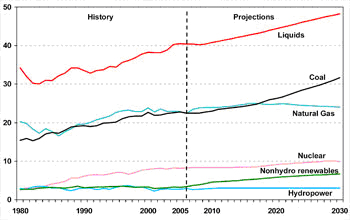

World crude oil prices will trend both up and trend down over the near to medium-term horizon. That change in pricing of crude oil is one economics driver for alternative fuels that almost equals the economic and legislative drivers to reduce greenhouse gas emissions. There seems to be little that can be done to control the largest greenhouse gas emission of all, water vapor. Domestic natural gas resources allows for expansion in the production of natural gas. The following figure is information from EIA.

For more informaion contact www.stix.market-research.com

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product