Reprinted with permission from Lincoln International Deal Reader - Solar Energy

Solar Industry Mergers and Aquisitions - Q3 2010

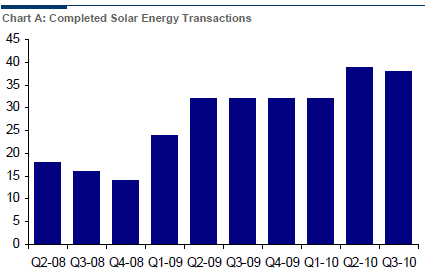

There were 38 completed solar energy transactions in Q3 2010 compared to 39 in Q2 2010. This number is the second highest number of transactions in a quarter since we began tracking M&A activity within solar energy. These statistics continue to show the increase of transactions within the solar industry since 2005, as the industry continues to grow. 2010 is on track to be another record year from a transaction perspective, largely driven by the continuing increase in consolidation transactions.

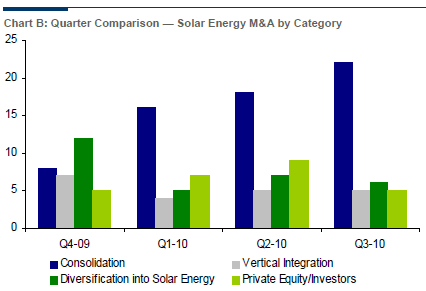

Within the solar energy transactions, consolidation represented 58% of transactions, or 22 deals in Q3 2010. The next largest category was diversification into the solar energy industry by corporations and investors with six transactions, or 16% of transactions in Q3 2010. Vertical integration and private equity/ investors accounted for five transactions each in Q3 2010, or 13% of the quarterly total each.

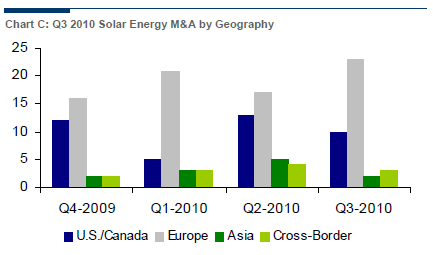

In Q3 2010, 23 transactions (or 61%) came from Europe. The number of transactions from U.S./ Canada in Q3 2010 was 10, or 26% of the total. Cross-border transactions accounted for three transactions, or 8% of the total for Q3 2010, while Asia represented only two transactions (5% of the quarterly total).

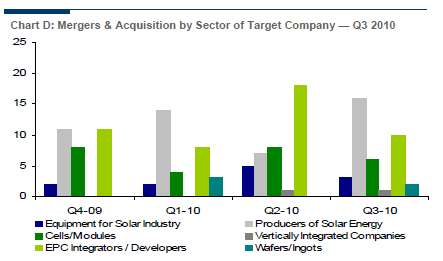

In Q3 2010, there were 16 acquisitions of companies categorized as solar energy producers, or 42% of the total transaction volume. This quarter had ten transactions for target companies categorized EPC integrators / developers, or 26%, while there were six transactions for cells / modules producers, or 16% of the total. There were three transactions of companies categorized as solar equipment providers and two transactions with companies categorized as wafer / ingot producers, or 8% and 5% of the total, respectively. Finally, there was one transaction with vertically integrated companies this quarter.

The upward trend in transaction activity has continued through the nine months of the year with activity increasing particularly within the consolidation category. Consolidation activity reached historical levels with 22 transactions for the quarter. These consolidation phases that are often seen in rapidly growing young industries present unique opportunities for companies to potentially sell at premium values benefiting from the overall market momentum. In addition, many of the consolidations occurring in the industry are acquisitions of solar projects as companies continue to build their project portfolios worldwide.

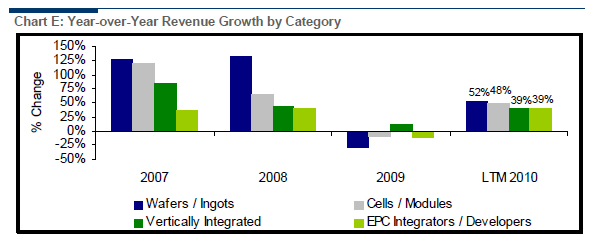

An Analysis of Growth Trends Affecting the Solar Energy Industry

The Solar Energy industry had its highest revenue total in 2008, more than any year since we began tracking this data. However, 2009 was a difficult year for the 35 solar energy companies tracked in Lincoln’s Solar Stock Index due to the global economic downturn. Year-over-year revenue was down in all categories except vertically integrated companies, who showed a modest increase in sales in 2009. On an LTM basis as of September 2010, all categories produced a sales increase of over 35% compared to the same period a year ago. As shown in Chart E, overall Solar Energy revenue during the last 12 months (LTM) has increased across all categories, perhaps not surprisingly in light of the recent overall market recovery. Wafers/Ingots providers’ revenue increased 52.5% on an LTM2010 basis versus a decrease of 13.2% for the same period a year ago. Revenue increased for Cells/Modules manufacturers by 47.9% compared to a revenue decrease of 13.6% for the same period a year ago. Vertically integrated companies’ LTM2010 revenue increased by 38.5% versus an increase of 3.7% in LTM2009. The EPC Integrators/Developers’ revenue increased by 39.3% in LTM2010, this compares to a 31.8% decline the same period a year ago.

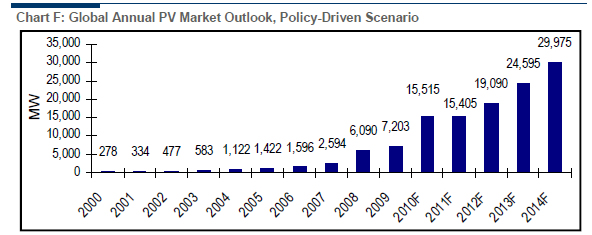

According to the European Photovoltaic Industry Association, growth in the PV industry is expected to exhibit a five year CAGR of 33.0% from 2009 to 2014. This assumes that countries continue to followup on existing and further introduce support mechanisms, namely Feed-in- Tariffs, in a large number of countries. Even under a moderate scenario, the CAGR is expected to be approximately 13.8% for the same period.

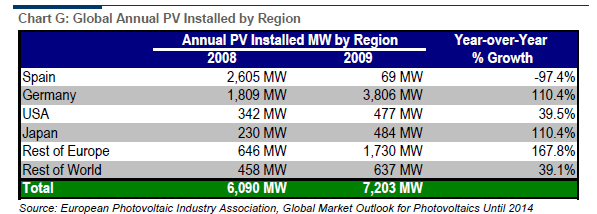

The largest installations during 2009 were in Germany with 3,806 MW, Italy with 711 MW, Japan with 484 MW and the U.S. with 477 MW. Due to the policy changes in Spain, installations in 2009 dropped sharply to only 69 MW, a 97.4% decrease for the year. Overall the top four markets had cumulative year-over-year growth in terms of annual installations of 101.5%, clearly highlighting the worldwide demand for additional solar PV.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With ten offices in Asia, Europe and North America, and strategic partnerships with leading institutions in China and India, Lincoln International has strong local knowledge and contacts in the key global economies. The organization provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

Lincoln International specializes in merger and acquisition advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With ten offices in Asia, Europe and North America, and strategic partnerships with leading institutions in China and India, Lincoln International has strong local knowledge and contacts in the key global economies. The organization provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.