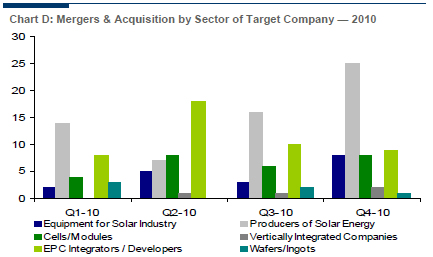

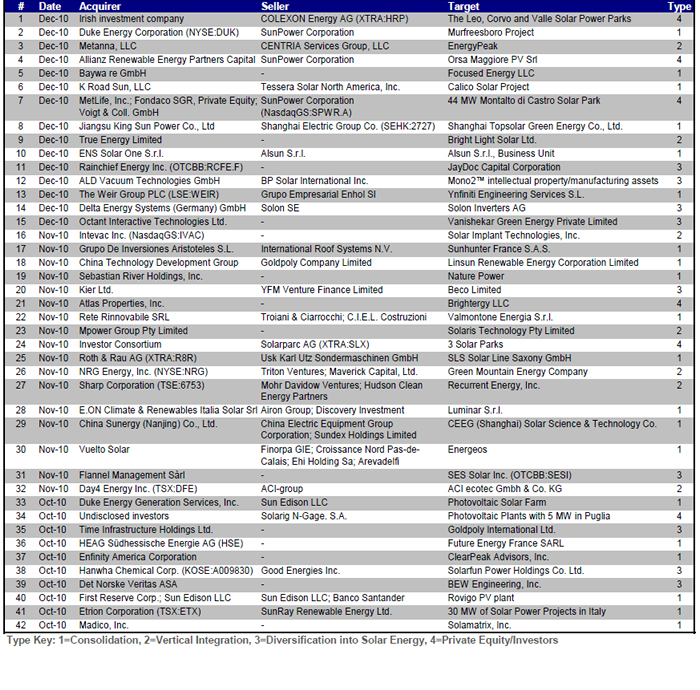

The transaction landscape of 2010 highlights the increasing consolidation trend within the solar energy industry. Primarily, this consolidation occurred later in the value chain with acquisitions of EPC integrators/ developers and producers of solar energy. This trend is expected to continue as companies and investors look to increase their portfolios of completed solar projects and pipeline opportunities.

2010 Solar Deal Volume Comparison

Contributed by | Lincoiln International

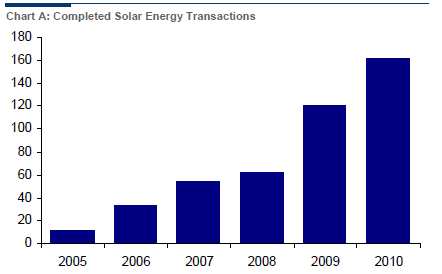

There were 162 completed solar energy transactions in 2010, nearly 40% more than the 120 recorded in 2009. The number of 2010 transactions represents over 2.5 times total deals in 2008, three times 2007 deals, nearly five times deals in 2006, and 15 times the number of 2005 transactions, when we began tracking M&A activity within solar energy. These statistics clearly show the consistent increase in transactions within the solar energy industry since 2005, as this industry is rapidly growing.

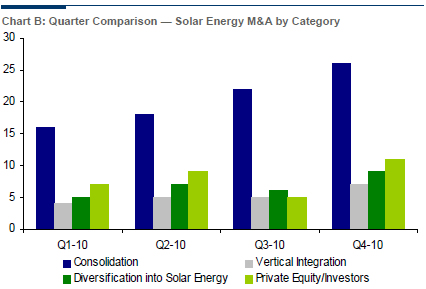

Within the solar energy transactions, consolidation represented 51% of transactions, or 82 deals in 2010. The next largest category was investments in the solar energy industry by private equity or private investors with 20% of transactions, or 32 deals in 2010. Diversification into the solar energy industry accounted for 27 transactions in 2010, or 17% of the total while vertical integration represented 13% of transactions, or 21 deals in 2010.

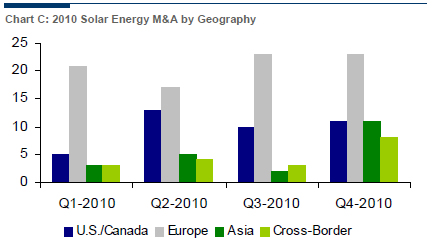

In 2010, 52% of transactions came from Europe, which is not surprising considering the importance of the European market within the solar energy industry. The number of transactions from U.S./Canada in 2010 was 39, or 24% of the total. Asia represented 21 transactions, or approximately 13% of the yearly total while cross-border transactions accounted for 18 transactions, or 11% of the total for 2010.

In 2010, there were 62 acquisitions of companies categorized as producers of solar energy, representing the most common category of targets. The next largest category of acquisitions was for companies categorized as EPC integrators/developers, with 45 transactions, or 28% of the total. Companies categorized as cells/modules producers accounted for 26 transactions, or 16% of total deals in 2010. Next, companies categorized as equipment for solar industry had 18 transactions, or 11% of the yearly total. Finally, companies categorized as wafers/ingots or vertically integrated represented only 6 and 4 transactions, respectively.

The transaction landscape of 2010 highlights the increasing consolidation trend within the solar energy industry. Primarily, this consolidation occurred later in the value chain with acquisitions of EPC integrators/ developers and producers of solar energy. This trend is expected to continue as companies and investors look to increase their portfolios of completed solar projects and pipeline opportunities. Also, with credit markets returning, private equity and private investors have become increasingly involved in transactions. As the solar energy industry continues to grow as it did in 2010, it can be expected that transaction activity will as well.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With ten offices in Asia, Europe and North America, and strategic partnerships with leading institutions in China and India, Lincoln International has strong local knowledge and contacts in the key global economies. The organization provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

Lincoln International specializes in merger and acquisition advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With ten offices in Asia, Europe and North America, and strategic partnerships with leading institutions in China and India, Lincoln International has strong local knowledge and contacts in the key global economies. The organization provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product