Is carbon trading a way for developed countries to ease their collective conscience while continuing to emit more and more greenhouse gases into the atmosphere? In this essay I will try to analyze the basics of carbon trading and the means to fulfill individual goals of each country.

Bill Bizios

Carbon trading comes in two forms: mandated and voluntary. In a mandated carbon trading scheme, often called cap-and-trade, countries or firms are forced to reduce their GHG emissions to a certain level (EU-ts is the main example of mandated market). In a voluntary carbon market, countries, firms, or individuals offset their emissions without legal necessity (voluntary markets are these of America)

Cap-and-trade

The idea of cap-and-trade is based on the fact that greenhouse gas emissions are a global problem, not a local one. Whether greenhouse gas emissions comes from Ireland or Delhi. The effect on global climate is the same. Therefore, cap-and-trade’s main goal is be to reduce overall emissions with little regard for their origin.

There are three basic ways to reduce our GHG emissions. First, we can reduce our use of carbon-emitting technologies and devices. For example, buying energy efficient products, install carbon collectors, modify energy producing systems in a low carbon system, reduces the need for utilities to burn fossil fuels to create your electricity, and therefore reduces total world carbon emissions. Second, we can improve the technologies we use by reducing the emissions they create. Third, we can develop projects that actively reduce atmospheric GHG. These projects are varied, from planting trees to recovering methane from landfills these projects called REDD are based on the sink system, meaning large theoretical tanks that ghg gases can be absorbed by.

Cap-and-trade schemes are an attempt to incorporate all three of these methods in the most economically efficient way. Under a cap-and-trade system, an overall cap is set on total emissions. The goal of the system is to reduce emissions below that level. Each participant in the cap-and-trade scheme either buys or is given so-called “allowances.” These are amounts (generally expressed in metric tones CO2 equivalent) of greenhouse gases that they are allowed to emit. The total number of allowances adds up to the cap.

The development of emissions trading over the course of its history can be divided into four phases:

1. Gestation: Theoretical articulation of the instrument (by Coase, Crocker, Dales, Montgomery, etc.) and, independent of the former, tinkering with "flexible regulation" at the US Environmental Protection Agency.

2. Proof of Principle: First developments towards trading of emission certificates based on the "offset-mechanism" taken up in Clean Air Act in 1977.

3. Prototype: Launching of a first "cap-and-trade" system as part of the US Acid Rain Program in Title IV of the 1990 Clean Air Act, officially announced as a paradigm shift in environmental policy, as prepared by "Project 88", a network-building effort to bring together environmental and industrial interests in the US.

4. Regime formation: branching out from the US clean air policy to global climate policy, and from there to the European Union, along with the expectation of an emerging global carbon market and the formation of the "carbon industry".

Here is how carbon trading works at its most basic level:

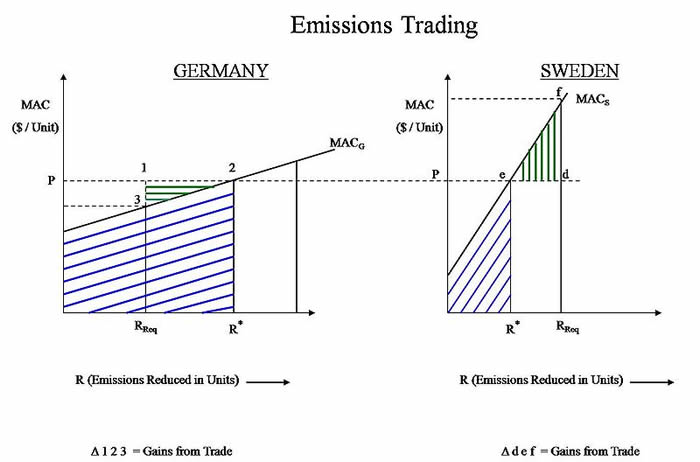

Consider two European countries, such as Germany and Sweden. Each can either reduce all the required amount of emissions by itself or it can choose to buy or sell in the market.

For this example let us assume that Germany can abate its CO2 at a much cheaper cost than Sweden, e.g. MACS > MACG where the MAC curve of Sweden is steeper (higher slope) than that of Germany, and RReq is the total amount of emissions that need to be reduced by a country.

On the left side of the graph is the MAC (Marginal Abatement Cost Curve— the cost of eliminating an additional unit of pollution) curve for Germany. RReq is the amount of required reductions for Germany, but at RReq the MACG curve has not intersected the market allowance price of CO2 (market allowance price = P = λ). Thus, given the market price of CO2 allowances, Germany has potential to profit if it abates more emissions than required.

On the right side is the MAC curve for Sweden. RReq is the amount of required reductions for Sweden, but the MACS curve already intersects the market price of CO2 allowances before RReq has been reached. Thus, given the market allowance price of CO2, Sweden has potential to make a cost saving if it abates fewer emissions than required internally, and instead abates them elsewhere.

In this example, Sweden would abate emissions until its MACS intersects with P (at R*), but this would only reduce a fraction of Sweden’s total required abatement. After that it could buy emissions credits from Germany for the price P (per unit). The internal cost of Sweden’s own abatement, combined with the credits it buys in the market from Germany, adds up to the total required reductions (RReq) for Sweden. Thus Sweden can make a saving from buying credits in the market (Δ d-e-f). This represents the "Gains from Trade", the amount of additional expense that Sweden would otherwise have to spend if it abated all of its required emissions by itself without trading.

Germany made a profit on its additional emissions abatement, above what was required: it met the regulations by abating all of the emissions that was required of it (RReq). Additionally, Germany sold its surplus to Sweden as credits, and was paid P for every unit it abated, while spending less than P. Its total revenue is the area of the graph (RReq 1 2 R*), its total abatement cost is area (RReq 3 2 R*), and so its net benefit from selling emission credits is the area (Δ 1-2-3) i.e. Gains from Trade

If the total cost for reducing a particular amount of emissions in the Command Control scenario is called X, then to reduce the same amount of combined pollution in Sweden and Germany, the total abatement cost would be less in the Emissions Trading scenario i.e. (X — Δ 123 - Δ def).

The example above applies not just at the national level: it applies just as well between two companies in different countries, or between two subsidiaries within the same company. However, the ultimate goal of reducing total emissions below a set level was achieved. Ultimately, every country will need to improve its own practices, but some can change more quickly and easily than others. This is the theory behind cap-and-trade.

Kyoto Protocol Participation

What is the Kyoto Protocol?

The Kyoto Protocol is an international agreement that arose from the United Nations Framework Convention on Climate Change (UNFCCC). Negotiations for the treaty ended in December 1997 in Kyoto, Japan. Currently, the Kyoto Protocol has 172 signatories which include all developed nations except the United States and Australia (Australia and US established voluntary carbon markets). The overall objective of the treaty is to reduce Greenhouse Gas emissions in developed countries 5.2% relative to 1990 levels by 2012, 20% by 2020 and according to the new ambitious decisions made from the European Commission of the UNFCCC, reduce ghg gases by 80-90% of the 1990 levels till 2050. However, individual countries have different goals, ranging from an 8% decrease in emissions in the European Union to a 20% increase in Iceland till 2020. These goals are designed to be implemented through a major multinational cap-and-trade scheme that includes all signatory nations.

How does it work?

There are four mechanisms through which the Kyoto Protocol attempts to meet these goals:

1) International Emissions Trading

This system allows countries that cannot meet their own emissions goals to purchase additional credits (called Assigned Amount Units or AAUs) from other countries that have been able to exceed their own goals. Systems have emerged among countries to facilitate this type of trading, the largest of which is the European Emissions Trading System (EU ETS). The EU ETS began on January 1, 2005 and has a two-phased system. The first phase, which ended December 31, 2007, has come under fire for providing too many credits to its members. As a result, prices for credits have been exceedingly low and the targeted emissions reductions have not been reached. Phase two runs from 2008-2012 with new allocations of credits and more stringent caps on emissions. Prices continued their descending course but from March 2011 the new goals set by EU gave a new a new thrust at carbon unit prices For more information on current carbon prices under EU ETS as well as the latest news on carbon markets, I highly recommend Point Carbon .

2) Domestic Emissions Trading

A number of countries have either implemented or considered introducing their own regional cap-and-trade schemes. These systems allow states, regions, or businesses within a country to trade emissions credits with each other in order to achieve the country-wide emissions goal. A major problem with these schemes is that they often introduce their own units for carbon credits, with their own elements and requirements. As such, there is often little coherence between international trading schemes and domestic trading schemes. There needs to be a single standard and unit for carbon credits. A global market would allow for more gains from trade and would lead to better success for the Kyoto Protocol.

3) Clean Development Mechanism (CDM)

As I explained in the beginning one of this post series, the goal of a cap-and-trade scheme is to reduce global emissions with little regard for their origin. Based on this concept, the Kyoto Protocol allows developed countries to offset their excess emissions by reducing emissions in developing countries, where such projects may be more cost-effective. Rather than, or in addition to, trading credits with other developed nations, some countries elect to finance emission reduction projects in developing countries through the CDM. Projects in the CDM must go through a complicated and relatively expensive approval process before being accepted as a qualified emissions reduction projects. There are currently 70 countries participating in the CDM with hundreds of project types.(Latest additions are S.Korea and India)

4) Joint Implementation (JI)

The Joint Implementation mechanism is often grouped with CDM because it is a very similar system. The major difference is that the countries in which projects can be built under the JI are primarily under the regulations of the obligatory trading. This is separate from the CDM because these countries are generally considered developed, but fit within their own category and develop Clean Projects beyond their obligations.

Overview

There is a lot of debate over the effectiveness thus far of the Kyoto Protocol. Detractors have a number of complaints. Their strongest complaint is that the EU ETS handed out far too many allowances (called EU Allocations or EUAs), misplaced the EUAs amongst European countries and in doing so flooded the market with credits and drastically reduced the need to reduce emissions. In addition, critics note that Kyoto extends only through 2012, not nearly long enough to achieve the sustained reductions necessary for mitigating the climate change crisis. Finally, it is widely accepted that many countries have not managed to set a rigid security system in order to avoid hack attacks (December 2010) to their national registries.

I am inclined to believe that despite Kyoto's (significant) flaws, it is a major step in the right direction. It is important to keep in mind that the Kyoto Protocol introduced by far the largest cap-and-trade scheme ever, and we are still in the very beginning stages of its implementation. I am hopeful that it will extend beyond 2020, and as regulators, countries, and industry alike become comfortable under the system, carbon prices will stabilize and significant emissions reductions will take place.

Resources:

- A Beginners Guide to the UN Framework Convention and its Kyoto Protocol/(Beloit College)

- Official UN Secretariat Guide to the Kyoto Protocol (PDF)

- Point carbon

- JI

- CDm

- http://en.wikipedia.org/wiki/Emissions_trading

Born 1985,Vasileios Bizios is an MSc. Mechanical Engineer & Aeronautics Engineer. He has graduated the University of Patras and his Msc is based in the areas of Aeronautics , Experimental Fluid Research and Energy.. Thus, in 2006 he accepted his first position as an Assistant of Professor Dr.Dionysius D. Margaris at the University’s Department of Mechanical and Aeronautical Engineering Laboratory where he gained extensive experience in the field of Fluid Research. Also during his college years he worked as an assistant at the laboratory For Manufacturing Systems and Automation. He is an active member of EUROAVIA and Upatras student Association. He graduated in 2010. His thesis was ‘Construction and experimental research of a subsonic widtunnel test section. He has numerous letters of recommendation from his Professors.

Born 1985,Vasileios Bizios is an MSc. Mechanical Engineer & Aeronautics Engineer. He has graduated the University of Patras and his Msc is based in the areas of Aeronautics , Experimental Fluid Research and Energy.. Thus, in 2006 he accepted his first position as an Assistant of Professor Dr.Dionysius D. Margaris at the University’s Department of Mechanical and Aeronautical Engineering Laboratory where he gained extensive experience in the field of Fluid Research. Also during his college years he worked as an assistant at the laboratory For Manufacturing Systems and Automation. He is an active member of EUROAVIA and Upatras student Association. He graduated in 2010. His thesis was ‘Construction and experimental research of a subsonic widtunnel test section. He has numerous letters of recommendation from his Professors.Recognized as a high-potential executive, in 2009, Bill’s career took a ten-fold leap in responsibility when he was sought out by Solar Technologies S.A and accepted a project developers position concerning Photovoltaic and wind Renewable Energy resources. Easily making the transition from project developer to Carbon Trading Research executive in 2010.Such a demanding research took place in the rather hostile (for new ideas )country Greece. He didn’t disappoint, championing the complete overhaul and modernization of the company’s possibilities to evolve in a Carbon Trading company.

Today, Vasileios Bizios resides Greece,. While open to opportunities, he has focused his search on CO2 or other senior technology executive roles in financial services, trading, acquisition-oriented, and other complex, information-intensive companies. Bill can be reached at 210-6198908 / vmpizios@solartechnologies.gr and he maintains a personal mail (vmpizios@gmail.com) with additional information regarding his career and his credentials.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product

SOLTEC - SFOne single axis tracker

SFOne is the 1P single-axis tracker by Soltec. This tracker combines the mechanical simplicity with the extraordinary expertise of Soltec for more than 18 years. Specially designed for larger 72 an 78 cell modules, this tracker is self-powered thanks to its dedicated module, which results into a lower cost-operational power supply. The SFOne has a 5% less piles than standard competitor, what reduces a 75% the labor time.