The Fuel Cell Industry Review 2014 offers data and analysis by region, application, and fuel cell type, and includes objective commentary on key events in the industry over the past year.

Reprinted with permission from | E4tech

Executive Summary

The fuel cell industry is still very much in the process of formation. The year 2014 has brought the loss of several high profile companies, such as Topsoe Fuel Cells, Lilliputian and ClearEdge Power, losses balanced by the entry of Korean conglomerate Doosan and a newly public commercialisation effort by General Electric. The year has also seen significant successful capital-raising by companies including Plug Power and FuelCell Energy, and the successful IPO of Intelligent Energy. Overall unit shipments are up compared to 2013, though the megawatts shipped are down. The industry remains predominantly focused on PEM and SOFC technologies, but other types remain strong, particularly MCFC in larger stationary power plants.

Although the MW of units shipped has decreased, we don’t interpret this too negatively. The number of units shipped is driven in large part by the Japanese residential fuel cell programme, Ene-Farm, and by very small portable products. The industry is small enough that a few big shipments one side or other of the New Year can still make a noticeable difference. In some cases, such as with cars, releases still tend to be in blocks, with subsequent pauses for learning and testing. Only when real commercial shipments occur in more sectors will some smoothing of the data occur.

The more successful sectors in terms of headline numbers remain the same as in prior years: in total, 100,000 Ene-Farm micro-CHP units in Japan have now been installed, and fuel cells outsell all other micro-CHP technologies. Korea, and particularly POSCO Energy, is ramping up installed MW of MCFC and increasing future orders. Bloom Energy remains an important contributor to installed SOFC capacity, though numbers look to be down compared to 2013, when last year’s very large Delmarva Power installation was booked.

Portable unit shipments and small battery charger-type systems seem to be gaining traction. While they have always been important for the likes of Horizon and SFC Energy, Neah Power, MyFC and Intelligent Energy also have big ambitions in the sector. Intelligent Energy has announced its intent to ship 50,000 units by year-end 2014, though shipments were not confirmed by press time.

In transport, the picture is varied. Outside of Europe, fuel cell buses seem to be losing ground, with BC Transit announcing the end of the 20-bus Whistler project, and AC Transit apparently also wavering in its support. In Aberdeen, Scotland, however, a ten-bus fleet is being assembled, whilst London plans to have eight by autumn 2014, and other projects are taking place across Europe. Hyundai shipped some fuel cell cars, Toyota and Honda are preparing for their official launches in 2015, but other companies – Daimler, GM, Ford, Renault-Nissan – are perfecting their technology for a later date. Special vehicles of different types remain in vogue, with Plug Power shipping increasing numbers of lift trucks, and various other utility vehicles entering real world demonstrations.

PEMFC is the main contributor to unit shipments, and significant in MW too. While shipments are on a slight upward trend, the launch of cars in 2015 could make a substantial difference to numbers. MCFC is dominant in MW shipped, due to FuelCell Energy (FCE) and to POSCO in Korea. SOFC of course has large units shipped by Bloom Energy, and other companies have been selling into residential micro-CHP. General Electric’s announcement of an SOFC plant in the US, while not relevant to shipment numbers now, is an interesting signal of possible things to come. While PAFC numbers suffered a setback with the demise of ClearEdge Power, Doosan has picked up the technology and is aiming for major shipments in 2015.

The big political picture seems most positive in Japan, where the Government’s energy strategy specifically discusses the importance of hydrogen and fuel cells and its ongoing support. European support is stronger than it has been in some time, both in the form of the European Commission’s renewed public-private partnership, the FCH 2 JU, and with national governments including the UK, France and Germany all continuing funding. In the US, research and demonstration budgets have declined but appear to have stabilised, and there is considerable new financing at the state level. California has affirmed strong backing for hydrogen refuelling station roll-out which should underpin the much-anticipated sales of cars.

2014 has not been an easy year for the fuel cell industry. While it is far from guaranteed, 2015 is shaping up to be a better one. Continued policy support in major jurisdictions, coupled with the coming of the fuel cell cars, big power park deployments in Korea, and hints that Japan may continue to underwrite its residential programme all suggest that shipments could be up significantly on 2014, and perhaps bring some new funding and confidence to consolidate this nascent industry.

Highlights

- A dramatic increase in hydrogen refuelling station deployment in Japan and California

- The first fuel cell vehicle lease to a customer in the US

- Increasingly large fuel cell power parks

- Japan’s explicit support of fuel cells and hydrogen in its energy policy

- The renewal – and expansion – of the EU FCH JU programme

- The spread of H2Mobility clones

Perspectives on the fuel cell ‘industry’ in 2014

The fuel cell ‘industry’ is actually not yet fully formed as an industry. Rather it consists of a number of diverse companies with different technologies, applications, market ambitions, routes to market, and supply chains. Company birth and death rates in this ‘industry’ remain high, and this is likely to continue for another year or so as the true value propositions for fuel cell applications emerge.

Despite this, life signs are broadly improving. The year 2014 saw several successful finance-raising events, including the initial public offering (IPO) of UK-based PEM manufacturer Intelligent Energy – the first fuel cell IPO in several years. Although supply chains remain thin and fragile, they are strengthening, and some global industrial corporations are even beginning to view fuel cell component manufacturing as a new growth opportunity. While the valuation of the few publicly quoted fuel cell companies is volatile, increasing orders, shipments and of course profitability, will help to increase market liquidity and smooth some of that variability. Importantly, government remains generally supportive in the same places it has in the past, and the finance sector is once again cautiously active, not only with the Intelligent Energy IPO but also with start-ups and growing companies.

While PEM and SOFC companies remain by far the most numerous, other chemistries retain important industry positions. MCFC shipments for large-scale power parks are a large part of the industry, while DMFC, AFC and even solid acid fuel cells (SAFC) all retain their place, each addressing specific customer requirements. And even though some major companies have left the sector, high-temperature PEM remains an important part of that branch of the fuel cell tree.

Our assembled and projected data show 2014 unit shipments as only marginally higher than 2013, and MW shipped as lower, which we discuss in more detail inside. In these early commercial years it is not at all surprising that the growth curve will be non-linear, as large occasional orders will dominate some market segments, and imperfect data availability will cause apparent swings. What is more important is that the building blocks being placed are genuinely supportive of growth.

On that note, the different players seem increasingly focused on their individual areas of strength. The largest potential markets, including residential combined heat and power (CHP) and automotive applications, are some of the hardest to enter due to low price points, strong incumbency, and a need for coalition approaches, including supportive policy. These markets are mostly being attacked by big companies, with deep pockets and the support infrastructures required for servicing and market expansion. The smaller markets are of less interest to these big players, but addressed by smaller companies who are increasingly specialised in their offerings – into materials handling, telecommunications backup, small-scale portable devices and similar. No company is trying to do everything, a significant weakness of the past.

Practical and sometimes innovative business models continue to emerge: instead of the historic approach of trying to sell fuel cells as fuel cells, companies are focusing more and more on the problems that fuel cells can solve, and the service revenues that come from offering ongoing solutions. Plug Power has for several years offered its customers a better economic opportunity than competing solutions for materials handling, while Intelligent Energy’s portable chargers allow more mobile phone usage and more revenue for mobile network operators in areas with weak or no electricity grids. Heliocentris’ energy management systems reduce current operating costs and pave the way for fuel cells to be integrated into future system configurations, for further savings and increased environmental benefit.

The data we present suggest that the total number of units shipped is expected to be larger in 2014 than in 2013. This growth is driven largely by portable products, such as mobile phone chargers and small auxiliary power units1. However, total MW shipped have declined from 2013. We believe that five companies account for more than 80% of the MW of systems shipped in 2014: FCE and Bloom Energy shipping into stationary prime power markets; Panasonic and Toshiba into residential CHP markets; and Plug Power shipping into the material handling market. Growth in shipments of relatively small-sized portable and transport units and the associated MW has not been sufficient to compensate for a dip in the shipments of large stationary systems.

Is the fuel cell industry relevant?

Markets for fuel cells to date have been completely dominated by policy and regulatory drivers. In Japan, a long-time leader in residential CHP installations, fuel cells enjoy enormous levels of government support. This government support is now increasing in time with impending roll-out of ‘commercial’ fuel cell cars. Korea, an equivalent leader in larger-scale stationary installations, drives this market through its aggressive renewable portfolio standard. And the reason there are fuel cell cars on the road in the first place, with more to come, is first and foremost a response to ever more stringent emissions regulations. This started with the California ZEV mandate and is now particularly driven by greenhouse gas policies.

Even with the support to date, the total number of fuel cells sold, and the capacity installed worldwide, is invisible on any overview of global generation capacity. Many major industry players – including some who previously had substantial programmes – remain well outside of the fuel cell world. China and India, for different reasons, remain interested but have other priorities. Large-scale generating capacity and transport will continue to be dominated by conventional fossil-powered solutions for decades to come. The fuel cell industry remains brittle, with high profile companies still failing or pulling out, and fragile supply chains.

However, outside of toys and education (which we exclude from our statistics) and small consumer electronics chargers, a few fuel cell applications do compete almost purely on economics. They usually favour small systems (<10 kW) and have not yet moved from niche to mainstream, though they are in that transition phase. The two most-cited examples are for telecommunications power and for material handling, with portable products also of interest. Unit shipments in these markets are amongst the most important in our figures, though detailed information on some aspects is lacking from the public domain.

Despite the limited number of immediate large commercial opportunities, and the still-nascent industry, the finance world is once again showing interest in the sector. The rise of the ‘connected world’, and the generally unforeseen implications of its spread into emerging economies, has important knock-on effects for novel technologies – such as fuel cells – in what appear initially to be less than obvious markets. India, a number of countries in Africa and the Middle East, parts of Latin America and South-East Asia are all home to fuel cell units shipped to respond to particular consumer needs, rather than to pick up local subsidies.

While only a handful of pure-play fuel cell companies are listed on stock markets, much major development is happening inside the larger organisations that have either retained or recently started a business. Specialist suppliers of ceramic powders, coated steels, novel polymers, and expert manufacturers of other materials and components are not only passive players in the supply chain but increasingly trying to understand how they can influence public support and end-user demand for fuel cells. They may order and install systems for their factories, aggregate technologies using their own global supply chain strength, or become vocal advocates of supportive policies.

New technologies – especially in energy – take decades to become relevant. But the pace of change in energy today is higher than ever, as is the uncertainty. Opportunities will continue to arise, and companies who understand fuel cells will increasingly create their own, as we see from some of the novel approaches already discussed. For fuel cells to become ‘relevant’ in terms of their relative percentage contribution to the energy and transport mix will take many years. Becoming relevant in other ways – providing opportunities in emerging economies, enabling autonomous distributed generation solutions, helping people join the connected world – could be much quicker. But fuel cells are already relevant to a substantial and growing number of customers who have begun to write repeat orders or to expand their portfolio of fuel cell purchases.

The body of this report contains the following topics.

- Shipments by region

- The Japanese Roadmap and hydrogen’s “central role”

- Europe’s Fuel Cell and Hydrogen Joint Undertaking

- Shipments by application

- Stationary fuel cells

- Shipments by fuel cell type

- Transport… holding its breath for 2015 33

- Portable power

For a free copy of The Fuel Cell Industry Review 2014, please click here.

The outlook for 2015

The purpose of this Industry Review is just that, to review. But we would be remiss if we did not take the opportunity to comment on what may happen in the coming year, though without attempting to provide quantitative forecasts.

The year 2014 was one of consolidation – voluntary or involuntary – for much of the nascent industry. 2015 is likely to be similar in terms of individual company development, but otherwise has the potential to be a watershed year. Despite the old adage that “fuel cells are five years away – and always will be,” the line drawn in the sand by the automotive manufacturers some years ago has not changed. In 2015 fuel cell cars will be available. They will be in smaller quantities than initially anticipated, and from fewer manufacturers initially, but available.

Most important may be some unexpected aspects of this launch: similar to the positive effect that fuel cell buses have on riders and drivers in cities they enter, the availability of fuel cell cars could have an important positive psychological impact on the general public. Or companies that have not yet chosen to enter the supply chain, due to a lack of visibility on when it might become profitable, may be more prepared to take a risk. Hydrogen refuelling infrastructure will start to be tested in earnest. And journalists and others will finally be able to compare commercial FCEVs with their direct competition, primarily BEVs, with a knock-on impact on policy-makers and financiers.

It will be interesting to follow the impact of announcements in the transport sector on developments in stationary power. Certainly Toyota’s aggressive visibility campaign in the US has made a palpable, if still small, difference in opinion-leader attitudes toward fuel cells generally. Analysts and journalists have become much more sophisticated since the peak of the hype cycle around 2001, when any mention of fuel cell success drove shares in the whole sector higher, regardless of their relevance to the specific chemistry or application. However, the view from 2014 suggests that shares in fuel cell companies still can move in lockstep based on individual announcements.

Although our aggregated data show a flat year overall, as some companies slow down, a small number of companies will ship much greater numbers of units in 2014. We expect more successes in 2015, though likely balanced again by declining sales or outright failures at other companies, and so overall shipments may still not take on the hockey-stick acceleration that financiers crave. Small systems such as chargers are likely to ship in greater numbers and are likely to end up dominating our unit shipment charts. Their increasing ubiquity may also start to increase consumer confidence in fuel cells as a whole.

In Europe, energy provision is in turmoil. Many large utilities have had to write off generating assets, including comparatively new gas-fired plant, and many are losing money. The implementation of renewables in different countries and the move from nuclear power has ripped traditional business models apart, giving alternatives some opportunity. The UK is operating at historically low capacity margins, giving rise to fears of imposed demand management, just to keep the lights on. The impact of this turmoil on the fuel cell industry is quite unclear. Uncertainty may bring opportunity, but it also brings increased risk, which may not help the relatively recent moves of Japanese residential fuel cell suppliers into Europe.

The general shape of the industry is unlikely to change dramatically, however. The bias towards PEM and SOFC appears entrenched, and while the other chemistries are likely to persevere, they will probably not dominate. Although MCFC can retain an important portion of the prime power and cogeneration markets, it will never be the single solution.

New twists on the technology will continue to emerge, and new companies too. Some of these may be implementing known technologies in different regions, for example through technology transfer from Europe and North America to countries like China. Some will have potentially new solutions to offer, through alternative materials or architectures. But these new companies will not be able to shortcut the need for extensive technology proving in the lab, in demonstrations and in the field before they can sell something a consumer will be comfortable buying. This suggests that many of the companies that are likely to succeed, when the industry finally matures, are already there.

For a free copy of The Fuel Cell Industry Review 2014, please click here.

Image Credits (in order of appearance):

For copyright information or permission to use any of the pictures in this report, please contact the relevant organisations.

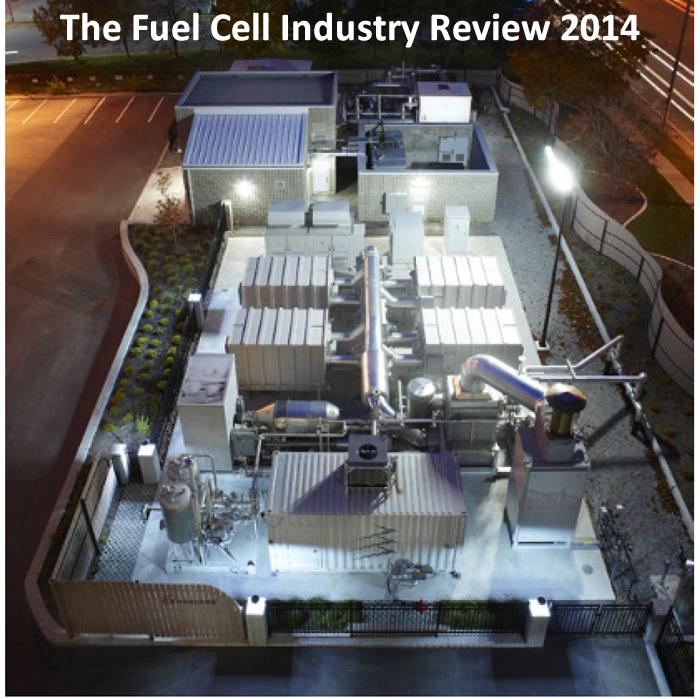

- Title - Copyright FuelCell Energy, Inc.

- Bloom Fuel Cells - Copyright Bloom Energy

- Ballard Fuel Cell - Copyright Ballard Power Systems Inc

About E4tech and the Authors

Since 1997, E4tech has been helping clients to understand and solve problems at the interface between energy technology, regulations and policy, and business opportunities. We have maintained our focus on innovative approaches to sustainable energy. We have in-depth expertise and long experience in sectors including biofuels, heat, power and chemicals; in low carbon vehicles; energy systems and storage; and in sustainability and resource analysis. Fuel cells and hydrogen are particular areas of strength, and we have carried out projects for early stage companies, SMEs, large corporates, financiers and governments worldwide. These projects range from market and competitor analysis through business strategy, technical and commercial due diligence, and support for policy development.

Since 1997, E4tech has been helping clients to understand and solve problems at the interface between energy technology, regulations and policy, and business opportunities. We have maintained our focus on innovative approaches to sustainable energy. We have in-depth expertise and long experience in sectors including biofuels, heat, power and chemicals; in low carbon vehicles; energy systems and storage; and in sustainability and resource analysis. Fuel cells and hydrogen are particular areas of strength, and we have carried out projects for early stage companies, SMEs, large corporates, financiers and governments worldwide. These projects range from market and competitor analysis through business strategy, technical and commercial due diligence, and support for policy development.The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product