White Paper contributed by Stäubli Electrical Connectors: Attention to the smallest detail always shows the biggest returns. Connectors may be small components, but their influence on the efficiency and bankability of a PV project is undeniable.

Small components. Big impact.

Contributed by | Stäubli

The big picture – Attention to the smallest detail always shows the biggest returns

The demand for safe, clean reliable renewable power is growing at an ever increasing rate. Today PV technology is not only ecologically, but also economically a sensible alternative for power generation. A large scale PV power plant has to be competitive against conventional energy sources as well as other PV projects. With the elimination of government subsidies for this kind of energy generation in many regions and markets, the focus has now shifted to the plant’s overall efficiency.

Minimizing CAPEX

In view of increasing cost-consciousness within all industrial sectors, the downward pressure on costs as well as on BOS components (balance of system) is becoming more and more crucial. Due to this, profitability has been lagging, so companies try to optimize CAPEX costs mainly and safe money on the components – often already during the phase of design.

*** Click here to view the entire Stäubli Electrical Connectors White Paper***

Securing profitability

But the real keys to improvement are both better capital and operational efficiency. Determining factor when it comes to favorable conditions for investment loans and credits is the profitability of a project during the operation period on the basis of reliable partners, components and an adequate operation and maintenance.

Decisive factor for your ROI

When it comes to the profitability and the return on investment of a PV project, a low LCOE (Levelized Cost of Energy) is the deciding factor. This crucial metric, expressed in cents per kilowatt hour (kWh), takes in account not only the capital cost of building a project, but also operating and maintenance expenses over time. It is used to compare the cost of solar energy to other sources and determines the long term profitability of a power plant.

Figure 1: Composition of LCOE

CAPEX, short hand for capital expenditure, is an expenditure which results in the acquisition of permanent asset intended to be permanently used in the business for the purpose of earning revenue; OPEX or operational expenditure applies to expenditure on an ongoing, day-to-day basis in order to run a business or system.

The concept of bankability – Minimizing risk, maximizing return

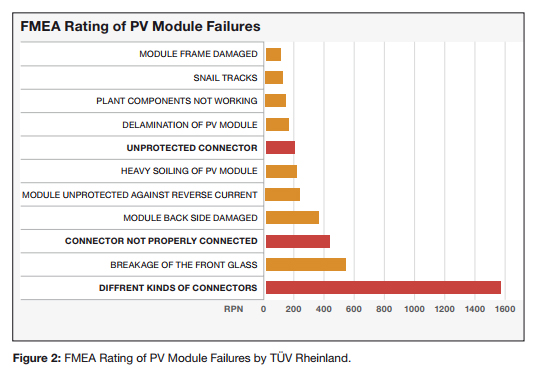

Prioritization of various risks, belonging to a certain phase and component, according to their Risk Priority Number (RPN). In the FMEA, each identified risk is evaluated for severity (S), occurrence (O) and detectability (D) and rated on a scale from 1 to 10 for each parameter. The RPN is obtained by multiplying those three factors and their given numbers (RPN = S x O x D). The higher the RPN, the higher the risk and substantial consequences on the PV plant and its profitability.

Generally speaking, in the solar industry, bankability is a term used to describe the degree of financial risk. The degree of bankability of any project, solution, technology or supplier will affect the availability and cost of capital.

Developers and investors have to assess the investment risk: Qualitative evaluation on technical and legal aspects. A quantitative economic evaluation with the focus on the balance between Total Initial Costs, Total Operating Costs and Levelized Cost of Energy.

The assessment is clustered in main dimensions of the project-due-diligence to rate from risk-perspective the reliability of the project-cash-flow. The stakeholders go through review process, have to be rated as bankable that particular PV-project get positive financial decision and to manage and mitigate risk.

Careful selection of bankable products and components to be built into the system is also a core topic, as these have considerable impact on the bankability and the economic success of a PV asset. In order to ensure a competitive LCOE and the long-term success of a PV system, but also the necessary financing, the appropriate, bankable project partners must be chosen.

The key to long-term efficiency

The guiding principle for bankability is to minimize risk while to maximize the return. This can only be achieved through secured efficiency in the long term on the basis of high-quality components. Wrong choices in planning, due to lack of knowledge or low-quality components, can cause unexpected loss of production or potential safety issue during the lifecycle of a PV system.

Solar Bankability Project

The EU-funded Solar Bankability Project aims to establish a common practice for professional risk assessment on the basis of existing studies and collected statistical data of failures in PV plants. Its risk analysis tends to assess the economic impact of technical risks and how this can influence various business models and the LCOE.

Failure Modes and Effects Analysis

In a first attempt, the project presents a cost-based Failure Modes and Effects Analysis (FMEA) to be implemented into the PV sector. It tries to define a methodology for the estimation of economic losses due to planning failures, system downtime and substitution/repair of components with respect to their impact on electrical and financial performance... (download the full white paper here)

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product