What got us till here may not be sufficient to take us to the finish line. Persistent efforts at an accelerated pace in the right direction is vital to reach decarbonization goals by 2035.

Post-Pandemic Economic and Development Challenges for Solar

Aasawari Pawar | Clean Energy Leadership Institute (CELI)

2021 has been a historic year for the US solar industry considering its market surpassed 100GW (dc) of installed solar generation capacity. In 2008, the total solar installation in US was less than 1GW, primarily localized in California. The exponential growth of solar is profound evidence of how energy intensive policies and significant technological advancements can help make renewable energy more affordable, accessible, and equitable. However, what got us till here may not be sufficient to take us to the finish line. Persistent efforts at an accelerated pace in the right direction is vital to reach decarbonization goals by 2035.

Key Drivers for Solar Growth

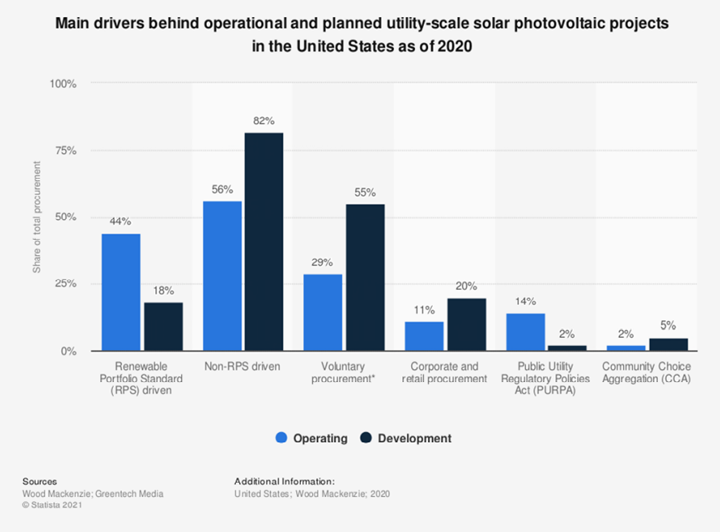

Solar has seen an average annual growth rate of 42% in last decade. The major drivers being:

Cost Depletion:

As per NREL’s David Feldman, “A significant portion of the cost declines over the past decade can be attributed to an 85% cost decline in module price”. The main factors for this decline were lower material and supply chain costs along with increase in module efficiency. This transformed photovoltaic (PV) power from an exclusive expertise into a technology that’s reshaping the energy system.

Strong Federal Policies:

The solar investment tax credit, enacted in 2006, has been one of the most successful federal policies for fast deployment of solar resources. A tax credit is essentially a dollar-for-dollar reduction in the income taxes that an individual or company would otherwise pay the federal government. Since the application of solar investment tax credit (ITC), US solar industry has seen growth more than 10,000%. Utility scale-solar project is eligible for ITCs based on the calendar year when construction of the project is determined to begin, starting at 26% for 2020 through 2022 and 22% for 2023. After 2023, the ITC for commercial projects drops to 10%.

Surge in Demand:

Voluntary procurement, corporate off-takes and state mandates have been driving US solar installations over the last few years. The renewable energy sector in the US has attracted over $500 billion since 2004, and now represents the nation’s largest source of private-sector infrastructure investments.

Current and Future Solar Installation

According to the Solar Futures Study report by DOE, solar could account for as much as 40% of nation’s electric supply by 2035. To achieve this target, U.S. must install an average of 30 GW of solar capacity per year between now and 2025 and 60 GW per year from 2025-2030. To put things in perspective, US solar market installed 5.7 GW (dc) of solar capacity in Q1,2021 which is way behind 30GW target required to meet decarbonization goals.

Post Pandemic Risk and Challenges

It is crucial for the solar industry to continue to grow at a rapid rate however, the pandemic created disruptions like:

Supply Chain constraints.

More than 80% of supply chain leaders surveyed by Capgemini in late 2020 reported that their supply chains were negatively impacted during the pandemic. Prices for raw materials like polysilicon, steel, aluminum have been surging post Covid-19. For instance, polysilicon, the substance from which both solar panels and computer chips are made, was at US$450/kg in 2000 and it had dropped to US$10.57/kg until last year. Currently, it is being sold at $29.41/kg.

Imposed ban on solar materials.

In June 2021, Customs and Border Protection issued a withhold release order (WRO) banning imports of silica-based products and goods from Hoshine Silicon Industry Company located in Xinjiang region of China. 95% of solar modules rely on solargrade silicon, and the Xinjiang region produces 45% of the world’s solar-grade silicon. The first major enforcement of the WRO came in August when roughly 100 MW of equipment was detained, and the inquiry would take at least 90 days to process. Unforeseen events like this could potentially lead to delaying solar projects to get onto the grid.

Tariffs on overseas made panels

The United States has imposed trade restrictions on imports of solar cells and panels starting in 2012, and since then, the number and nature of these restrictions has increased. The Section 201 extension and the anticircumvention petition have the potential to considerably increase duty liability on imports of solar products.

Next Steps

Due to the ongoing coronavirus crisis, there may be a temporary slowdown of solar capacity additions for the first time in history. The consequence of such setbacks could be potential miss of clean energy goals as per the Paris Climate Agreement. As a result, an immediate focus on below areas is required -

- To eliminate the dependency on any specific region, we would need policies to nurture ideas for parallel processes using ethical and sustainable models.

- Diversifying supply base to other regions which are demographically close to consumer location which will provide opportunities for under-developed regions to facilitate innovations and creation of new low-cost model.

- The pandemic uncovered blind spots in the supply chain processes which could be used to re-invent strategies by offering substantial economic and environmental benefits amidst opportunities to promote environmental justice.

- Public and private sectors should make commitment towards unified process mapping to achieve global sustainability KPI.

With pressing global concerns, clean energy leaders should prioritize innovation and adopt best practices to fight climate change. I strongly believe the future of solar will continue to evolve with the help of advanced policies and technologies.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product