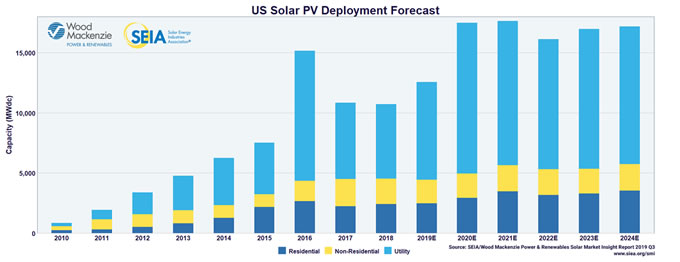

U.S. Utility Solar Pipeline Soars to 37.9 GW, A New Record

|

WASHINGTON, D.C. and HOUSTON, TX - The U.S. solar industry now has the largest pipeline of utility-scale solar projects in history, signaling promising future prospects for solar energy development.

### |

|

About SEIA®: |

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product