ENERGY TRANSITION INVESTMENT HIT $500 BILLION IN 2020 – FOR FIRST TIME

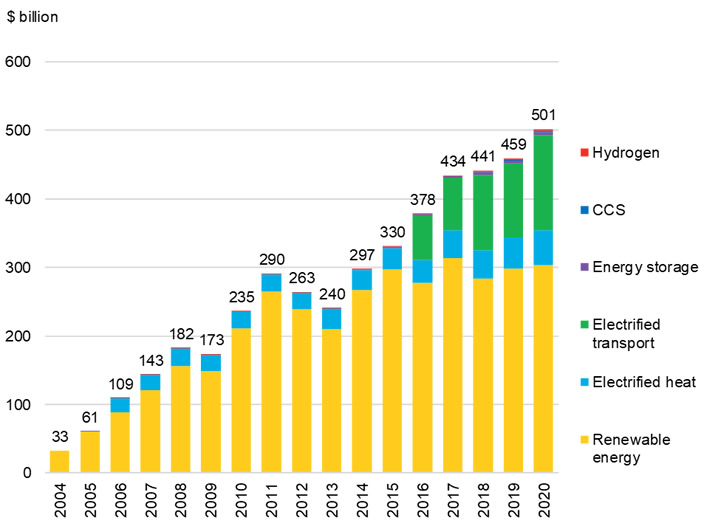

London and New York, January 19, 2021 – A new, broad measure of ‘energy transition investment’, compiled by BloombergNEF (BNEF), shows that the world committed a record $501.3 billion to decarbonization in 2020, beating the previous year by 9% despite the economic disruption caused by the Covid-19 pandemic.

BNEF’s analysis shows that companies, governments and households invested $303.5 billion in new renewable energy capacity in 2020, up 2% on the year, helped by the biggest-ever build-out of solar projects and a $50 billion surge for offshore wind. They also spent $139 billion on electric vehicles and associated charging infrastructure, up 28% and a new record.

Other areas of energy transition investment also showed strength. Domestic installation of energy-efficient heat pumps came to $50.8 billion, up 12%, while investment in stationary energy storage technologies such as batteries was $3.6 billion,[1] level with 2019 despite falling unit prices. Global investment in carbon capture and storage (CCS) tripled to $3 billion, and that in hydrogen was $1.5 billion, down 20% but the second-highest annual number to date (see Figure 1).

Albert Cheung, head of analysis at BNEF, said: “Our figures show that the world has reached half a trillion dollars a year in its investment to decarbonize the energy system. Clean power generation and electric transport are seeing heavy inflows, but need to see further increases in spending as costs fall. Technologies such as electric heat, CCS and hydrogen are only attracting a fraction of the investment they will need in the 2020s to help bring emissions under control. We need to be talking about trillions per year if we are to meet climate goals.”

A geographical split of BNEF’s energy transition investment data shows that Europe accounted for the biggest slice of global investment, at $166.2 billion (up 67%), with China at $134.8 billion (down 12%) and the U.S. at $85.3 billion (down 11%). Europe’s impressive performance was driven by a record year for electric vehicle sales, and the best year in renewable energy investment since 2012.

Jon Moore, chief executive of BNEF, said: “The coronavirus pandemic has held back progress on some projects, but overall investment in wind and solar has been robust and electric vehicle sales jumped more than expected. Policy ambition is clearly rising as more countries and businesses commit to net-zero targets, and green stimulus programs are starting to make their presence felt. Some 54% of 2016 emissions are now under some form of net-zero commitment, up from 34% at the start of last year. This should drive increasing investment in the coming years.”

A pack of charts illustrating the trends in energy transition investment discussed above is available via the following link. The pack also includes slides showing a number of ‘thematic highlights’ of 2020 including low-carbon investment by oil and gas companies ($12.7 billion in 2020), the 10-fold growth of clean energy exchange-traded funds in just one year, and the seemingly inexorable rise of sustainable debt. BNEF’s “10 Predictions for 2021”, are also published today, and can be read via this link.

Figure 1: Global energy transition investment, 2004-2020

Source: BloombergNEF. Note: electrified heat figures begin in 2006; electrified transport in 2016; hydrogen and CCS in 2018.

Renewable energy investment

Global investment in renewable energy capacity[2] moved up 2% to $303.5 billion in 2020. This was the second-highest annual figure ever (after 2017’s $313.3 billion), and the seventh consecutive total of more than $250 billion. Falling capital costs enabled record volumes of both solar (132GW) and wind (73GW) to be installed on the basis of the modest increase in dollar investment.

Highlights of the renewables investment total included a leap of 56% in financings of offshore wind projects to $50 billion, including the largest deal ever in that sub-sector – $8.3 billion for the 2.5GW Dogger Bank project in the U.K. North Sea. The year also saw the largest single solar park ever funded, the 2GW Al Dhafrah in the United Arab Emirates, at a cost of $1.1 billion.

Overall, solar capacity investment was up 12% at $148.6 billion, and wind (onshore and offshore) down 6% at $142.7 billion. Biomass and waste-to-energy financings were down 3% at $10 billion.

In terms of regions, renewable energy capacity investment in Europe, at $81.8 billion, up 52%, was its highest since 2012 and almost caught up with China, at $83.6 billion, down 12%. The U.S. fell 20% to $49.3 billion, as wind investment almost halved, and India slipped 36% to $6.2 billion.

Renewables capacity investment rose 10% in Japan to $19.3 billion, 177% in the U.K. to $16.2 billion and 221% in the Netherlands to $14.3 billion. Spain was up 16% at $10 billion, Brazil up 23% at $8.7 billion, Vietnam 89% higher at $7.4 billion, France 38% up at $7.3 billion, and Germany 14% up at $7.1 billion. Other markets seeing $3 billion-plus totals included Taiwan, Australia, South Korea, Poland, Chile, Turkey and Sweden.

Public markets and VC/PE

BloombergNEF also continues to track investment by the public markets and venture capital and private equity players in renewable energy and the closely related area of energy storage. In 2020, specialist companies in these areas raised a runaway record figure of $20 billion via share issues on public markets, up 249% on the previous year.

The biggest deals included $2.8 billion raised by Chinese battery maker Contemporary Amperex Technology, or CATL, $846 million from U.S. fuel cell company Plug Power, and $777 million from Chinese PV manufacturer JA Solar Technology.

Venture capital and private equity investment in renewables and storage increased 51% to $5.9 billion last year. Both this, and investment via the public markets, took place against the backdrop of buoyant share prices: the WilderHill New Energy Global Innovation Index, or NEX, which tracks about 100 clean energy stocks worldwide, rose 142% in 2020 to record levels.

This positive investor mood helped electric vehicle companies raised some $28 billion from stock market investors in 2020, up from just $1.6 billion in 2019, according to BNEF estimates. Last year’s total was seven times the previous record, in 2016.

About BloombergNEF

BloombergNEF (BNEF) is a leading provider of primary research on clean energy, advanced transport, digital industry, innovative materials, and commodities. With a team of experts spread across six continents, BNEF leverages the world’s most sophisticated data sets to create clear perspectives and in-depth forecasts that frame the financial, economic and policy implications of industry-transforming trends and technologies. Available online, on mobile and on the Terminal, BNEF is powered by Bloomberg’s global network of 19,000 employees in 176 locations, reporting 5,000 news stories a day. Visit https://about.bnef.com/ or request more information.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product