Third-generation thin-film solar devices are beginning to emerge in the marketplace after approximately 20 years of research and development, due to the insight of leading material developers such as Konarka and Plextronics in the organic photovoltaics (OPV) domain, and Dyesol, EPFL, G24i, Mitsubishi and Peccell on the dye-sensitized cells (DSC) front. Both DSC and OPV technologies lag far behind on the efficiency curve when compared to conventional solar (i.e., >20 percent efficiency), so they will likely succeed in markets where their low cost, substrate flexibility, and ability to perform in dim or variable lighting conditions provide them with a significant competitive advantage.

Timm Rohles | RE:SEARCH

DSC will target larger area BIPV applications while OPV will find its application in lower power consumer applications. The success of penetrating existing and new PV markets will depend on many variables, including:

- costs in $/Wp, as well as $/m2 of product and power availability (kWh/Wp/annum);

- the technical and environmental profile of each newly introduced technology;

- added value for the consumer and architects; and

- ease of production and the scale at which a production plant becomes economically feasible.

At this stage, third-generation PV is not at a price point to be able to compete directly with silicon-based cells or the more exotic thin-film technologies, but it will nevertheless play a significant energy role in applications and markets that conventional solar materials will never be able to penetrate. These include low-power consumer electronics, outdoor recreational applications, and BIPV applications.

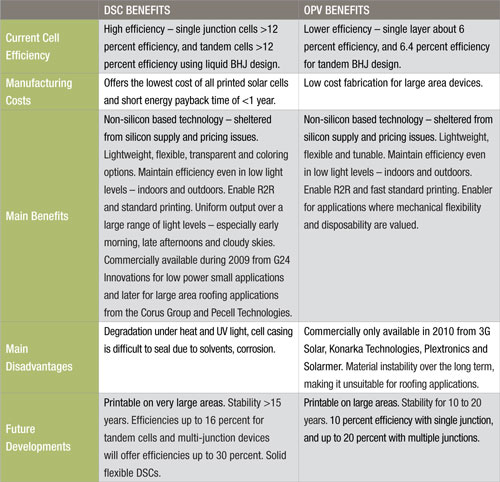

Comparison of Third-Generation Thin-Film Solar Technologies

Consumer Electronics

There is considerable anticipation over the pending production of these novel devices, since they will be able to come in at price points far below existing technologies, though initially they will likely not be as reliable. One of the first commercial DSC products offered last year was G24i’s low-cost solar charger, which provides affordable power to recharge mobile phone batteries and other mobile electronics in the rural areas of Africa. This is a vast market, where some 160 million mobile phones were sold in 2008 (comprising 20 percent of world sales last year), and phenomenal growth of up to two billion handsets is forecast by 2015. LG Electronics, Samsung, and Sharp recently demonstrated mobile phones powered by silicon solar panels, and it seems only a matter of time until DSCs will replace these panels. In fact, GTM Research believes that all mobile devices should have some sort of solar-power feature to “trickle-charge” batteries when they are not in use, a feature that will increase the duration between full charges. The objective is to arrive at a technology that is small, but at the same time is able to convert energy efficiently. DSCs will likely be the prime candidate that will achieve both of these ends in the future.

Third-generation thin-film-based technologies offer a significant advantage over conventional silicon and over other standard thin-film technologies, in that they do not lose power dramatically under shaded or variable light conditions, but rather continue to collect energy even in low-light situations, making them an excellent source for lighting applications. Several developers are working to take advantage of DSCs’ abilityto power various non-grid-based lighting applications. Sony has demonstrated elegant Japanese-style lanterns, as a proof of concept design for using DSCs as power source.A variety of low-power consumer applications are beginning to emerge on the market. Self-energy converting sunglasses that use DSC solar panels cleverly integrated into the lenses have been designed and will be available to power up portable electronic devices in 2010. Other novelty products including solar calculators, clocks, SWATCH watches, toys, and greeting cards are also expected to enter the market as soon as stability and cost issues have been resolved, and will eventually come to replace conventionally used solar silicon-based panels. The OPV materials developer Plextronics has been working with NTERA, and has demonstrated a self-powered display that integrates a NanoChromics display with power generation being supplied by a Plextronics OPV cell. The most innovative aspect of this display is that it does not require any active electronic components.

Printed color-changing displays like this one are now being utilized on smart cards, novel packaging solutions, point of purchasing advertisements, and a host of other emerging product applications. By combining energy-harvesting OPV technologies with printed displays, it is possible to achieve cost-effective, self-powering solutions for these applications.

Outdoor Recreational Applications

Conventional solar panels have been used in a variety of outdoor recreational settings for some time, especially in cars, but also in boats. Given the world market’s increasing demand for “green” energy, this market offers a significant opportunity, but will require more efficient and cost effective materials. The principal problems with such energy systems arise from the relatively small amounts of energy being generated, often at disproportionately high costs. The advent of third-generation thin-film solar technologies is set to change this, given the increasingly efficient levels of performance that are now being obtained, especially with DSC and OPV devices and their associated lower costs. Since the days of the first electric car almost 100 years ago, solar panels have been used as a means to power cars for short periods of time. During the 1990s, however, panels were incorporated into the solar sunroof of the Mazda 929 luxury sedan to drive fans that removed hot air from the car. Aisin Seiki and Toyota Central R&D Labs have been developing DSC for use in cars, and plan to launch products around 2010. Hyundai has started its own DSC program, and at the Seoul 2009 international auto show, the company showed off its new BLUE-WILL plug-in hybrid concept car, which featured integrated DSC panels in the roof to increase battery storage. Other added-value features that could be driven by DSC panels include sensor power and atmospheric control that could continue to charge when the car is not in use. Lotus designed the Smart for Two concept car, powered by a 37-kW motor and a lithium ion battery pack, which itself draws some power from the car’s roof-mounted solar panels. Solar panels are also now being integrated into airplanes. The U.S. Air Force Research Laboratory and the University of Washington are working together to develop DSCs for airplanes using a flexible thin glass coating and transparent conductive electrodes, which are expected to be available by 2013. In the area of smart fabrics, textile applications require highly flexible, low-cost solar cells in order to generate smart fabrics and this appears to be a good match up with third-generation thin-film solar cells. For the last few years, solar bags have been catching on, given the heightened environmental awareness of consumers. Noon Solar is one such company capitalizing on these emotions, with plans to offer a new range of biodegradable leather handbags and laptop solar bags (priced from $300) using Konarka’s PowerPlastic material by the end of 2009. These bags will have the ability to recharge a phone battery within three hours using direct sunlight, offering a complement to its existing range of bags based upon conventional silicon panels (amorphous Si). Solar clothing is also progressing, with articles such as blouses, jackets, ties and swimwear having been developed to power devices such as mobile phones and MP3 players. Conventional silicon-based materials are for the most part used in these applications, but will likely be replaced by DSC/OPV materials as soon as efficiency, stability, and cost issues are improved. Power-to-the-uniform is an important application for the military, as a means to help lighten the soldier’s field kit. DSC could also be used in detachable patches worn to prevent friendly fire, or to alert soldiers to the presence of chemical or biological contamination. DSC-powered generating units are being used to provide a “Power Shade” that fits over the U.S. Army’s tent structures. These shades come in different configurations and can generate up to 2 kW of power for sheltered electronics or battery recharging. The U.S. Army has been working to reduce the weight of the soldier’s uniform and kit by using DSC panels to charge their vision goggles, laptops, communication devices, and GPS units and keep them operational while in the field. This will lead to increased mobility, as well as helping to save lives by providing an emergency backup power-generating device.

Sunshades for umbrellas and tents are a unique application that is being pursued by several developers. Australian-based company SKYShades is now installing its novel tension membrane structure, incorporating Konarka’s Power Plastic at a test site in Florida’s West Palm Beach. The structure is being mounted over eight car bays, where the power will be stored and will feed into the columns to provide lighting for the car bays and power points for recharging electric cars and in doing so, will provide carbon offsets. SKYShades anticipates that its solar membrane parking structures will also be installed at many shopping centers and airport car parks around the world, as the prevalence and popularity of electric cars increases.

Conventional and embedded sensors are another novel direction that both DSC and OPV developers are pursuing, with both Dyesol and Konarka Technologies currently working in this area. These new sensors will be used for environmental monitoring and hazardous gas detection, as well as to provide a more accurate picture of the carbon footprint. The key to creating cost-effective sensors is to use power train components that can be optimized specifically for the application.

BIPV

With the renewed interest in solar energy that is developing across the board, BIPV technology has progressed to third-generation systems, whereby solar modules are being fully integrated into the building envelope and are therefore able to replace conventional building materials. It is this generation from which the largest opportunities will likely emerge, because these products can be applied to a variety of settings including roofs (roof-integrated photovoltaics or RIPV), walls, facades, and windows. Corus is developing products for use in RIPV applications using Dyesol’s DSC materials, and will be one of the first companies to commercialize its metal-based RIPV products, with early models appearing by 2011. Corus believes that many industrial buildings, which are typically covered with steel sheets, will be generating solar electricity using its solar paint, especially given that there are in excess of one billion square meters of coated steel roofs erected each year around the world. Solar windows and skylights present an exciting market opportunity given the huge window areas available to collect solar energy and the aesthetically appealing nature of these products. The transparency of these windows does change, which may be beneficial to workers’ or residential dwellers’ comfort, and could reduce glare and heat at the sunniest times of the day. Konarka Technologies is collaborating with Arch Aluminum & Glass to develop solar materials to replace conventional building materials for integration into semi-transparent glass for various commercial BIPV applications. These materials are more flexible, lightweight and transparent, making them more aesthetically suitable for BIPV applications. Other active developers include Fraunhofer ISE/ColorSol Consortium, New Energy Technologies, and Solarmer. Konarka’s PowerPlastic for rooftop applications is expected to be competitive in terms of both cost and efficiency by 2010. Another of Konarka’s partners in BIPV is SKYShades, which itself views the installation of integrated ‘solar OPV membranes’over existing sheet metal roofing systems as a substantial growth opportunity. ‘Roofs’ have historically been non-income earners for property owners, and now they are able to offer an installation which can generate ‘clean, green’ power to augment electricity needs – and in the case of larger roof areas – to feed into the grid. In either case, there will be a cost savings redirected to the property owner. The company has been working with Konarka for the past few years and is currently demonstrating its novel structures at a factory in Brisbane, Australia, where it has installed a 200m2 solar membrane structure on the rooftop. It plans for wide-scale commercialization by the end of 2009 or early 2010.

Power Generation

Harvesting energy directly from sunlight using DSC and OPV technologies is a way to address global energy needs, while at the same time minimizing detrimental effects on the environment by reducing atmospheric emissions, especially CO2. DSC and OPV devices are easier to manufacture than current silicon-based PV technology, and if efficiency and costs can be improved, then they show great potential as a source for both on-grid power generation, as well as off-grid systems. NREL has stated that DSC technology has the potential to produce electricity that is “grid competitive,” meaning, at the same cost to the consumer as electricity supplied from fossil fuel power stations. On a practical level, researchers at Risø’s DTU have been working with Mekoprint A/S and Gaia Solar A/S, and connected their OPV solar cells to the grid at Risø, at a cost of €15/W in March 2009 and less than €5/W by the end of 2009.

About 1.6 million people live without electricity in the world, so there is a real need to provide electricity for off-grid applications, especially in Africa and India. The “Lighting Africa” program is addressing the need to develop cheap and efficient lighting and energy solutions for those live without access to the electricity grid. As part of this program, G24i and Lemnis are developing off-grid lighting devices that use light emitting diodes (LEDs) and DSCs.

Evolution of Third-Generation Thin-Film Solar Materials and Technologies

One of the greatest appeals of third-generation thin-film solar cells is that they can be manufactured using solution-based, low-temperature roll-to-roll manufacturing methods, incorporating conventional printing techniques on flexible substrates, which presents the opportunity for a more economical alternative for solar cells within the next few years. Such new low-cost third-generation solar cells will offer larger surface areas with enhanced performance. However, to enable long-term use of DSC and OPV in conventional electricity generation, e.g., in grid-connected or stand-alone rooftop applications, significant progress in cell efficiency, stability, and lifetime are needed. With respect to lifetime, there is much discussion going on as to whether the technologies need to have the same lifetime as silicon-based PV (20+ years) for economical rooftop use, or whether shorter lifetimes of around 5 years, especially for very low-cost modules, could be deemed acceptable (this is, in fact, the direction that Konarka and SKYShades are taking). However, there is some evidence to suggest that for mass production for top grid-connected and building-integrated solar cells, optimal lifetime duration should be at least 20 years, since investors are less likely to support a technology with low efficiency and lifetime.

This executive summary is taken from the report Third-Gen Thin-Film Solar Technologies: Forecasting the Future of Dye Sensitized and Organic PV“ by GTM Research. This report and many more (free) studies about renewable energy, energy efficieny and cleantech you may find on RE:SEARCH – Cleantech portal for in-depth market reports.

This executive summary is taken from the report Third-Gen Thin-Film Solar Technologies: Forecasting the Future of Dye Sensitized and Organic PV“ by GTM Research. This report and many more (free) studies about renewable energy, energy efficieny and cleantech you may find on RE:SEARCH – Cleantech portal for in-depth market reports.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product