This year's World Market Updated includes a full chapter dedicated to Direct-Drive WTG versus Gearbox-Equipped WTG. The increased use of the direct-drive turbines across the wind market is impacting the wind industry. The World Market Update 2010 identifies and compares the pros and cons of both the direct-drive and gearbox-equipped concepts, as well as the implications of using permanent magnets on a large scale.

International Wind Energy Development: World Market Update 2010

Contributed by | BTM Consult – A Part of Navigant Consulting

The 100+ page World Market Update 2010 is BTM Consult’s Sixteenth Edition of this annual wind energy market report. The report includes more than 80 tables and graphs illustrating wind market development – one of the world’s fastest growing industries – a five-year forecast to 2015, and predictions for the market through 2020.

- Record installation of 39.4 GW

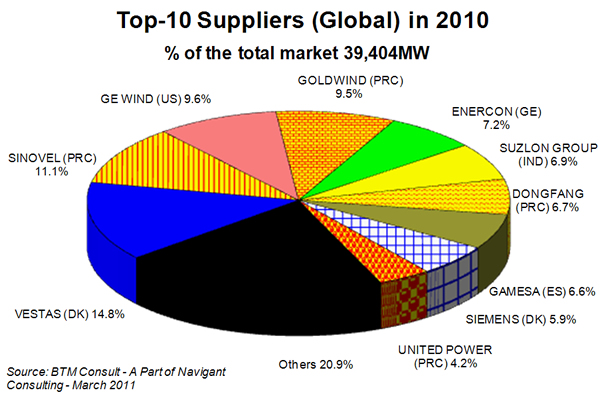

- Strong presence of four Chinese wind turbine suppliers in the “Top 10” list

- China now the leading market globally, with 18.9 GW of new capacity

- Offshore wind power is on track for increased contribution to Europe

- Market value is expected to grow from €66.8 billion in 2011 to €111.7 billion in 2015*

- Direct-drive turbines now account for 17.6% of the world’s supply of wind power capacity

- Wind power is expected to deliver 1.92% of the world’s electricity in 2011*

- Current indications are that wind power is expected to be able to meet 9.1% of the world’s electricity demands by 2020*

- 9,404 MW of newly installed wind power capacity

- Cumulative installed capacity by the end of 2010 reached 199,520 MW. Around 24,000 new wind turbines were erected across more than 50 different countries

- Europe lost its previous position as the largest wind power continent. 27.9% of all new installation in 2010 took place in Europe, but the continent’s share is decreasing. Four years ago the European share was 51%

- The Americas dropped dramatically compared to 2009. It was caused by fall in the U.S. market, where 5,115 MW of new capacity was added. That was around half of its installation in 2009 Altogether the Americas accounted for 16.8%

- Asia experienced significant growth. Including the OECD Pacific, the region increased its cumulative capacity from 42,037 MW in 2009 to 63,645 MW in 2010, a growth of 51.4%. China was by far and away the leading country, with 18,928 MW of new capacity in 2010. India saw an increase to 2,139 MW of new installations. The region as a whole accounted for 54.8% of the year’s global total

- Among the Top 10 markets China kept its position as largest in 2010, followed by the US. Germany installed 1,551 MW in 2010. UK and Spain improved their position, with 1,522 MW and 1,516 MW respectively

- Penetration of wind power in the world’s electricity supply has reached 1.92%, the proportion expected to be produced in 2011

- Along with a modest upscaling in turbine capacity from the supply of more multi-MW turbines for use on land, the demand for offshore wind turbines was significantly higher than the previous year, with 1,444 MW supplied in 2010. The average turbine size delivered to the market was 1,655 kW, slightly higher than in 2009.

- A significant trend was the increasing supply of wind turbine concepts with a direct drive design. This emerging technology accounted for around 17.6% of the world market in 2010, represented mainly by Enercon (GE) and Goldwind (CN) and Hara XEMC (CN)

- In the Asian markets smaller turbines are preferred. The average size delivered to India in 2010 was therefore 1,293 kW, whereas the average delivered to the UK market reached 2,568 kW. In China the average turbine supplied was 1,469 kW

- Utilities and IPPs are the dominating customer group in today’s market. The Top 15 wind farm operators in this customer segment controlled around 33.6% of the aggregate installed capacity in the world at the end of 2010. They build and in many cases own and operate the largest new wind farms in the US, Spain, China and the UK.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product