Locational Capacity will be the dominant application in 2016. In other words, battery systems targeted at the grids most congested load centers will be first and foremost used to provide four hours of peak shaving capability, and other grid balancing services when available.

Breakout Year for Energy Storage

Philippe Bouchard | Eos Energy Storage

Where do you see the energy storage industry within the next year? 5 years?

In 2016, energy storage will clearly establish itself as a commercially viable industry—one that offers a strong value proposition for stakeholders in the electricity supply chain, and without government subsidies. Major utilities will continue to solicit energy storage solutions and, for the first time, long-duration (or multi-hour) applications will emerge as the primary driver of energy storage deployments in the U.S.

By 2020, energy storage will be accepted as another tool in the utility toolkit. Grid-connected battery systems will be ubiquitously deployed alongside conventional transmission and distribution upgrades and new gas peakers. Energy storage will help to flatten out the infamous “duck curve” in California and will help to integrate roof-top solar as net energy metering tariffs phase out. In five years’ time, energy storage will be truly global: batteries will represent an integral component of electricity grids in developing countries that opt for distributed solutions as opposed to massive investment in centralized generation and delivery infrastructure.

Who do you think will continue to be the top players within 2016?

The energy storage landscape in 2015 was a bit of the wild west and that will continue in 2016. Upcoming energy storage service providers and asset developers, such as Stem, Convergent Energy + Power, and Hecate, will duke it out with “the Bigs,” or established independent power producers like Nexterra, AES Energy Storage, and SunEdison.

Emerging energy storage technologies, such as Eos’ zinc hybrid cathode battery, will continue to make their mark in 2016 while the incumbent Li-ion players fight to gain and retain market share. Big name system integrators—such as General Electric, Toshiba, and NEC Energy Solutions—will diversify their product offerings to include non-lithium chemistries, leveraging valuable experience and balance sheet to make emerging technologies bankable and to create competitive advantage in an already saturated market.

What will the top application be for 2016?

Locational Capacity will be the dominant application in 2016. In other words, battery systems targeted at the grid’s most congested load centers will be first and foremost used to provide four hours of peak shaving capability, and other grid balancing services when available. In 2014 and 2015, 260MW of energy storage contracts were awarded by Southern California Edison and 75MW by Pacific Gas & Electric to different suppliers and technologies—all of which will have to provide 4-hr peak shaving to support resources adequacy. This same application will begin to see traction in New York City, where permitting agencies have been working to streamline the approval process for installation of batteries in and around buildings. As long-duration applications build momentum, shorter duration applications such as frequency regulation will begin to lose steam given market saturation and a forthcoming cap on “pay for performance” services in PJM.

Through a global perspective, where do you see industry expanding?

Based purely on inbound expressions of interest, India, South Africa, and Australia are beginning to emerge as hot markets for grid-connected energy storage. India and South Africa face similar problems: 4-hr rolling brown outs are used to “manage” demand in light of insufficient generation capacity, particularly during times of peak demand. In these markets, the industry has been forced to ensure its own power quality and reliability, typically through installation of back-up diesel generators. This lack of grid stability creates an opportunity for energy storage to act as a clean, green, and most importantly cost-effective reliability resource for the end-user.

In Australia and in many regions across the world, you have populations spread over a large landmass which requires allocation of expensive delivery infrastructure over relatively small kWh loads. This drives high electricity rates, specifically high demand charges since transmission and distribution is sized to serve system peak and recouped based on customer’s peak load. Distributed energy storage can reduce costs by optimizing utilization of existing T&D infrastructure or, in places like Africa, it can be paired with a distributed generation source to obviate the need for that infrastructure all together. From a global perspective, we will soon witness the emergence of the battery storage enabled micro grid!

Please explain your thoughts on the rise of behind-the-meter storage.

The rise of behind-the-meter storage can be explained by three key drivers: clear and transparent pricing signals, lucrative incentives, and quick interconnection to the grid. Utility tariffs are available to anyone, meaning developers can evaluate customer load profiles to determine the payback on batteries used for demand reduction. California, currently the largest market for behind-the-meter storage at >11MW installed, offers a lucrative $1.46/Watt incentive through the Self Generation Incentive Program (SGIP). This program is expected to be oversubscribed within minutes of accepting applications when the program opens for 2016. Finally, battery systems can be installed behind the meter more quickly than assets can be developed on the grid, given lower lead-time interconnection agreements and lack of wholesale market registration.

The strongest business case for behind-the-meter storage is one that optimizes end-user and utility value. In this example, the utility will pay the behind-the-meter asset for contracted services, e.g. a 4-hour peak shave on a hot summer day. When the battery is not required by the utility, it can reduce the customer’s demand charge and provide other grid services. This is the basis for the $2.1/W payment for participation in Con Edison’s demand management program, which is driving the deployment of energy storage in New York City.

There was a major announcement in the Li-ion industry including Tesla launching its residential battery solution, the PowerWall, and major Asian manufacturers—Samsung, BYD, and LG Chem—planning to build Gigafactories to bring down the cost of Li-ion through greater economies of scale. How will this affect the industry and what actions will technology players such as Eos have to take?

Economies of scale and decreasing price points from these Li-ion manufacturers is a fantastic thing for the grid-connected energy storage industry. Tesla and others are helping to establish a category that didn’t exist before; homeowners and building owners are beginning to think about how batteries can reduce energy costs, better integrate renewables, and improve power quality and reliability. These announcements put the onus on competing technologies to be cost competitive and crystal clear about their value proposition to the customer. Lightweight, energy dense Li-ion batteries may be great for installation in the home and well-suited for power applications such a frequency regulation; however, they are not necessarily the best fit for long-duration peak shaving applications—with a typical project life of 10, 15, or even 20 years.

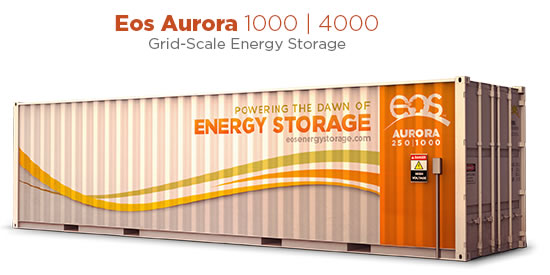

At Eos, our mission is to provide cost-effective energy storage solutions that are not only less expensive than other battery technologies (of which there are still relatively few on the grid today), but less expensive than the most economical alternative used today to provide the same services—gas turbines for peak power generation and transmission and distribution assets for delivery capacity. Our zinc hybrid cathode (ZnythTM) technology enables a price point of $160/kWh for the Aurora 1000│4000, a 1MW/4MWh DC battery system, which supports a 15 year life assuming one full charge and discharge per day. This price point is 30-50% less expensive that the next best Li-ion battery and, for the first time, creates and energy storage solution that is cost competitive with gas peakers and copper wire. That’s when things start to get interesting!

Do you think the Government will get behind the need for energy storage and bring is some support in the way of subsidies or tax incentives?

We believe that energy storage offers a strong, self-standing value proposition—both to the utility and the end-user. We don’t advocate for subsidies or tax incentives. We simply push for an even playing field in which energy storage solutions can be fairly evaluated and deployed alongside other conventional solutions.

Philippe Bouchard, Vice President – Business Development

Philippe joined Eos after 5 years of in-depth experience leading emerging technology and regulatory initiatives within the utility energy industry. While working previously within Southern California Edison’s Advanced Technology Organization, Philippe co-authored SCE’s Smart Grid Deployment Plan and managed a $3 million portfolio of diversified R&D and technology evaluation projects. Philippe also completed SCE’s 2-year Marketing Analysis & Planning Strategy (MAPS) rotation program where he lead keystone projects within the arenas of Advanced Technology, Demand Response and Regulatory Policy & Affairs. In this rotational capacity, Philippe lead development of General Rate Case testimony for SCE’s Plug-in Vehicle Readiness Program and helped to propose and implement customer demand response programs leveraging newly implemented smart metering and home area network technology platforms. Philippe previously worked as a research analyst for E Source—an energy research and consulting firm– where he specialized in demand-side management programs, smart grid technologies, and corporate greenhouse gas consulting. Philippe brings an interdisciplinary background in chemistry and environmental sciences and graduated with a B.A. from Pomona College.

Philippe joined Eos after 5 years of in-depth experience leading emerging technology and regulatory initiatives within the utility energy industry. While working previously within Southern California Edison’s Advanced Technology Organization, Philippe co-authored SCE’s Smart Grid Deployment Plan and managed a $3 million portfolio of diversified R&D and technology evaluation projects. Philippe also completed SCE’s 2-year Marketing Analysis & Planning Strategy (MAPS) rotation program where he lead keystone projects within the arenas of Advanced Technology, Demand Response and Regulatory Policy & Affairs. In this rotational capacity, Philippe lead development of General Rate Case testimony for SCE’s Plug-in Vehicle Readiness Program and helped to propose and implement customer demand response programs leveraging newly implemented smart metering and home area network technology platforms. Philippe previously worked as a research analyst for E Source—an energy research and consulting firm– where he specialized in demand-side management programs, smart grid technologies, and corporate greenhouse gas consulting. Philippe brings an interdisciplinary background in chemistry and environmental sciences and graduated with a B.A. from Pomona College.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product