An extension of the solar Investment Tax Credit (ITC) – the main driver of solar growth in the United States – was unexpectedly included in an omnibus spending bill agreed upon in Washington, D.C. late Tuesday night. It will be finalized and voted on later this week.

Global Solar Industry Saved from 2017 Cliff-Edge as US Set to Extend Solar ITC

Ash Sharma and Josefin Berg | IHS Technology

Key Facts:

An extension of the solar Investment Tax Credit (ITC) – the main driver of solar growth in the United States – was unexpectedly included in an omnibus spending bill agreed upon in Washington, D.C. late Tuesday night. It will be finalized and voted on later this week. The key points for solar power are:

- The ITC will be extended from Dec 31, 2016 and instead stepped down from 30 percent to 10 percent until 2024. Projects that start construction by 2019 will receive the current 30 percent ITC, while projects that begin construction in 2020 and 2021 will receive 26 percent and 22 percent, respectively. All projects must be completed by 2024 to obtain these elevated ITC rates.

- For residential photovoltaic (PV) systems, a similar tax credit phase-out applies until December 31, 2021, after which the tax credit scheme ends.

Situation:

In the early hours of this morning, the U.S. Congress agreed on a bill that would see the solar Investment Tax Credit (ITC) extended by an additional five years, as part of a $1.15 trillion spending bill. The House is expected to vote on the legislation on Thursday or Friday. Although sudden opposition could block immediate approval of the full bill, it looks close to certain that the ITC extension will go ahead.

In addition to an extension of the solar ITC, production tax credits for wind installations will also be introduced, in return for a removal of a 40-year long ban on oil exports from the United States

IHS Analysis

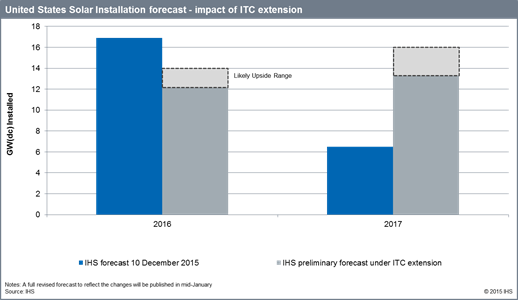

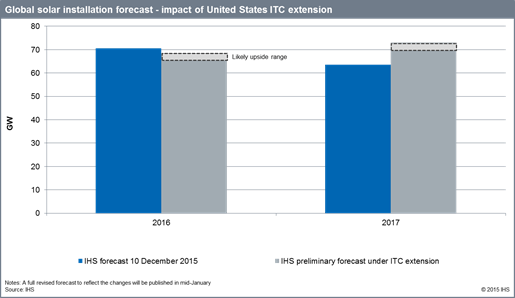

Analysis conducted just two weeks ago by IHS, prior to the extension of the ITC forecast that U.S. solar installations would reach nearly 17 gigawatts (GWdc) in 2016 driven by the rush from developers to finish projects ahead of the December deadline. This would then lead to a drop to just 6.5 GW in 2017. The impact on the global solar industry would have been huge. IHS previously predicted global installations would peak at 70 GW in 2016 – a 20 percent increase over 2015 and largely driven by the huge demand from the United States; however, the cliff-edge in demand facing the country at the end of 2016 would have led to a global decline of 10 percent in 2017, with installations falling back to 63 GW.

This projected decline was based on a bottom-up assessment of more than 70 countries globally, based on known policy conditions. The effects of a sharp contraction in the United States was expected to be compounded by a stagnation of demand in China and Japan – both of which, like the U.S., had previously experience boom years.

The extension of the ITC for solar power projects -- and the changed deadline criteria from “placed in production” to “started construction” -- relieves the solar industry of the pressure to complete projects in 2016. For projects that are contracted to come into place by the end of 2016, IHS anticipates that developers will renegotiate the deadlines for the least advanced projects. The majority of pipeline projects that are not yet ready for construction are forecast to be completed after 2016, with peaks in 2020 to 2023. In parallel, the extension of tax-credits for residential PV enables steady growth of this segment through 2022.

Currently, the PV project pipeline in the United States amounts to 58 GW, of which 20 GW have power purchase agreements (PPAs) in place. According to initial assessments from IHS, the five-year extension of the ITC could spur developers to continue growing the pipeline at the current rate of 15 GW per year. Given the overhauled conditions, a high-level, initial assessment conducted by IHS now projects U.S. installations of 12 GW to14 GW in 2016, with 3 GW to 5 GW of utility-scale projects to be shifted from 2016 to later years. IHS forecasts U.S. installations to grow between 13G and 16 GW in 2017.

The result of the extension to the solar ITC is not just good news for the U.S. solar market, but is a net positive for the global solar industry as a whole. While prior to the extension of the ITC IHS forecast a 10 percent decline in global installations, this forecast has now been reversed. Global solar installations are now expected to reach between 66 GW and 68 GW in 2016, growing to between 70 GW 73 GW in 2017.

Other changes to the ITC proposed would also create a more stable environment for the global solar industry as reductions to the credit would be stepped down over several years rather than a hard cut-off. In addition the cut-off date for support for projects would be assessed based on when a project starts its construction rather than when it is completed.

The sharp fall in solar installations which was modelled before the extension to the ITC also had major consequences for the supply chain, with IHS previously predicting a sharp correction in both solar hardware prices and also overall system prices. Whilst our full analysis will take further time, we expect a much more moderate decline in pricing over the next two years at least and a much more stable and predictable environment for the supply chain as a result.

In today’s global business economy, access to reliable, accurate data is crucial to making the best possible decision—every time.

As the premier provider of global market, industry and technical expertise, IHS understands the rigor that goes into decisions of great importance with solutions that meet the needs of our customers.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product