Solar Tariffs Hold Back Q3 Installations, Scramble Project Timelines As Procurement Pipeline Booms

|

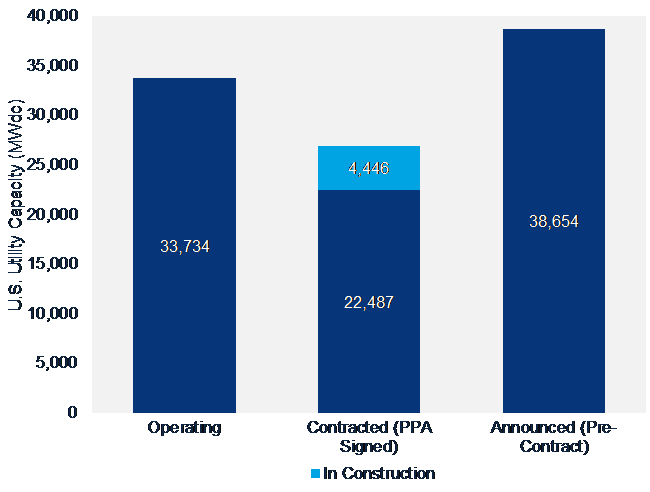

BOSTON, Mass. and WASHINGTON, D.C. - The Section 201 solar tariffs took a toll on utility-scale solar installations in the third quarter according to the U.S. Solar Market Insight Report for Q3 from Wood Mackenzie Power & Renewables and the Solar Energy Industries Association (SEIA). The residential market, meanwhile, continued to stabilize after a down 2017. Overall, the analysts expect 2018 growth to be flat. FIGURE: U.S. Utility PV Pipeline

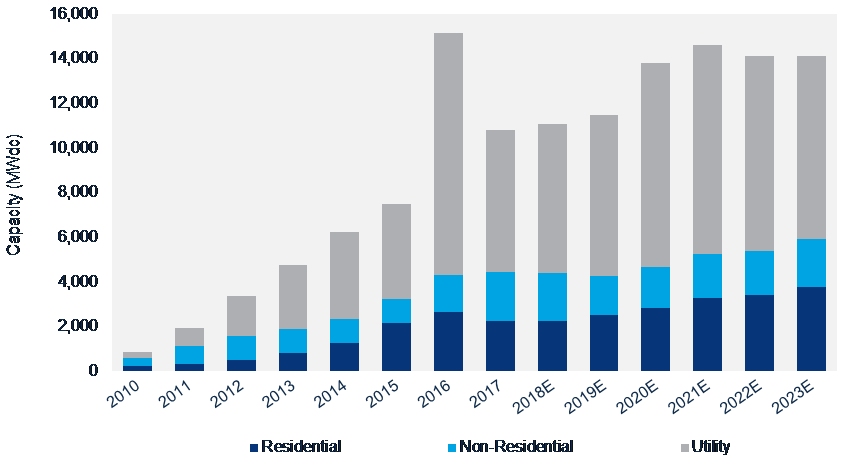

On the residential side, Q3 was the third consecutive quarter in which residential PV was essentially flat or marginally up on both a year-over-year and quarter-over-quarter basis after the market had contracted by 15 percent in 2017. Nevada was a particular bright spot as the state experienced steady installation growth, and Florida is on pace for a strong year. Slightly improving their 2018 forecast, Wood Mackenzie now expects a total of 11.1 GW of new PV installations to come online by the end of the year. The report said there was positive quarterly growth in the non-residential solar segment despite a year-over-year decline. California’s commercial sector experienced solid growth and New York saw a record-breaking quarter. Minnesota’s community solar build out continued, with more than 400 megawatts added so far this year. “If not for the tariffs, the U.S. solar market would undoubtedly look better today than it does now,” said Abigail Ross Hopper, SEIA’s president and CEO. “However, as this report shows, this is a resilient industry that cannot be kept down for long. With smart policies in place, the potential for the solar industry is hard to overstate.” Total installed U.S. PV capacity is expected to more than double over the next five years. By 2023, more than 14 GWdc of PV capacity will be installed annually. FIGURE: U.S. PV Installation Forecast, 2010-2023E

KEY FIGURES

|

|

About U.S. Solar Market Insight: |

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product